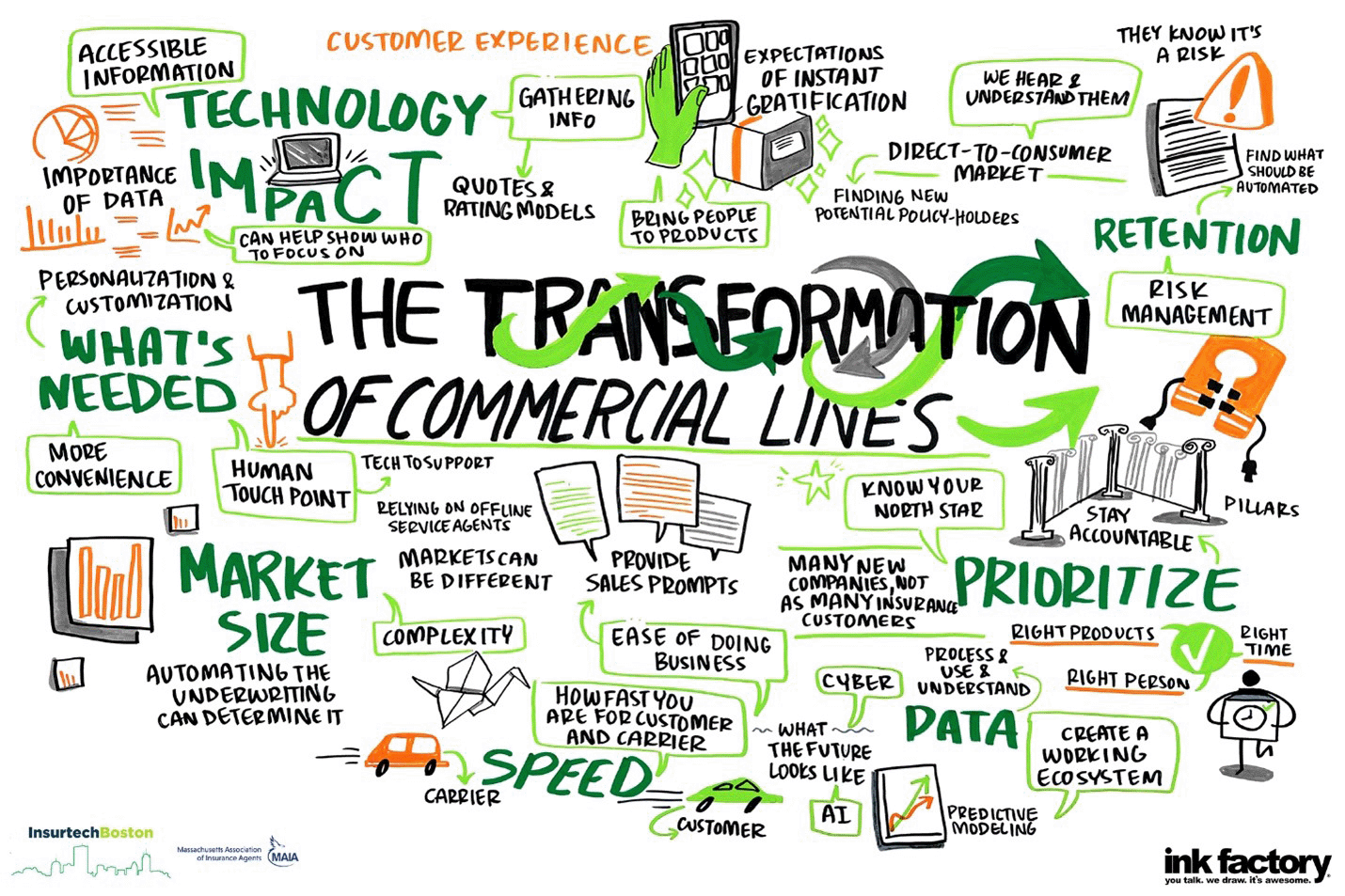

The use of technology to support the Commercial Lines insurance lifecycle is constantly evolving and was the focal point of a panel conversation we had at Insurtech Boston. We’re all working to find that perfect balance of human interaction and technology that supports the best customer experience.

In the second post of this series based on the Insurtech Boston panel sessions, our expert panelists talk all about the state of technology and Commercial Lines. The panel speakers included Coterie VP of Distribution Bobbie Collies, Simply Business Product Manager John Pegnato, and Bindable Chief Product Officer Risa Pecoraro.

“Where does it matter to have a personal or human touch point, and where does technology add value? That’s one of the challenges we’re trying to solve collectively. That’s why we’re all here.”

Bobbie Collies, VP of Distribution, Coterie InsuranceTechnology Impact

Our panelists shared what they believe are the areas where technology has had the most positive impact in the past two years.

Risa said she has seen information become more accessible online throughout the process. “Several businesses have been focused on distribution because the way people want to start the journey has changed a lot,” she said. “I think they’re making more information available online even if they want to finish that journey with a trusted agent.”

John agrees that more is moving online, including the data collection process. “The buying process and customer information gathering have primarily moved online,” he said.

Bobbie has started to see the impact of data and Artificial Intelligence in the industry. “Data and early artificial intelligence have changed how quickly and accurately we can get a Commercial Lines quote turned around, “she said.

Commercial Lines Pain Points

We have seen the start of a transformation in Commercial Lines with technology, but there are still pain points and areas that need improvement.

Risa said she believes there is more opportunity for personalization. “It’s too complicated for people unfamiliar with insurance and may not know what general liability means. I think bringing them on the journey with more personalization will help,” she said.

John said he sees an opportunity for the industry to do more with data – using some of the same concepts from Personal Lines and face-to-face tactics agents use with customers.

“I think the Commercial Lines space has an opportunity to do more with data. The Personal Lines space does a fairly decent job of that today.”

John Pegnato, Chief Product Officer, Simply BusinessBobbie pointed out the need for a value proposition and bringing along stakeholders like agents in the journey. “It’s important to bring agents along on the journey and find your value proposition as technology gets inserted into the space,” she said.

Market Size Needs

Does the industry need different technology solutions for each market segment – from small to mid-market to large? Are they truly different animals?

Bobbie said she thinks it’s more about the complexity of business than the size of the market. “I think there is going to be a transition based on the data that we have available to us. It’s not necessarily micro, small or large market, but is it a risk that’s easy to automate underwriting? That’s where technology can come in and support that. But the more complex risk, whether it’s Personal Lines or a large contractor, will have different needs in the tech space,” she said.

John said he views the segments differently but agrees that the level of complexity plays a role. “I view the spaces very differently. I do think it’s natural that middle market becomes more complex. I agree that it’s mostly about the complexity of the business. It stands to reason that as the business gets bigger, it is more complex and needs better underwriting tools and support for agents as they go to market,” he said.

Risa said when it comes to communication, the needs are the same for all segments.

“At the end of the day, they are all still human beings who are not insurance experts trying to make a buying decision. There is a lot of room to leverage technology to help inform across segments. The needs are different, but communication is needed across the board.”

Risa Pecoraro, Chief Product Officer, BindableSpeed and Risk

We hear a lot about the need for speed in the industry. Clients want more speed – from carriers to agents to consumers – in Commercial Lines. Is there a risk with moving too fast?

John said there is a risk, but it’s all about learning as you go. “There’s always a risk when you go fast, but it’s a matter of how fast you learn and applying those learnings,” he said.

Bobbie said she sees the industry moving from a slower speed to learning how to be more agile.“Traditionally, we have not been an agile industry, so speed is scary and we’re learning how to be agile together. There is friction between the carrier and technology providers and how we can all figure out that comfortable speed to work together,” she said.

Risa said she sees speed as an area where segment does play a role. “This is one area where I think segment does matter because of the complexity of underwriting; mid-market can probably test and learn a little more easily,” she said.

Picking and Choosing the Right Tech

With so many shiny new technology tools, how do you choose which solutions work for your business?

Risa said you must stay true to your organization and choose pillars of importance. “You have to know what your north star is and what you’re going towards. If you don’t know that, it’s difficult to prioritize because everything will look good,” she said. “Pick between three and five pillars and invest in those. I choose by holding myself accountable to strategy.”

John has three standards that he uses to decide what to invest in. “Scalability, sensibility and flexibility are the gold stars for me. If we can prioritize those things, it allows us to live the strategy,” he said.

Bobbie agrees with Risa that a value proposition or north star is key to driving your decisions. “You have to intentionally focus on what you’ve chosen to be your value proposition is as an organization and where you want to be in the market. To Risa’s point, you have to know your north star,” she said.

More From Insurtech Boston

Look for at least one more post based on our superb panel sessions from Insurtech Boston. Find out more in our broker technology panel post, Insurtech Boston recap post, and on the Insurance Technology podcast featuring Insurtech Boston founders Mike Albert and Allan Egbert.

-

Taira Mandy

Director of Customer Success

Taira Mandy is the former Director of Customer Success at Ivans. The Customer Success team helps carriers better meet their goals while using Ivans products and services. Prior to this role, Taira managed customer success for the Ask Kodiak platform. In addition, she has direct experience working in product management for a P&C carrier.