Are you ready to reshape the future of the insurance industry with technology? One important piece of that is reaching the rising generations in insurance, and this is the second article in a series that focuses on new Gen Z and millennial research. Both generations share a deep connection with technology and have the potential to shape the future of insurance. The key is attracting and retaining these generations as employees and customers.

Perspectives from Gen Z & Millennials

We recently surveyed insurance professionals in these generations and chatted with three tech-savvy young professionals – including Mamadou Bah, business development manager at RT Specialty; Cassandra Koegel, commercial lines producer at Eastern Insurance and MAIA Young Agents Committee co-chair; and Raghav Tanna, Applied SVP of small commercial. Let’s look at what these professionals say about work environments, tech, and transparency.

-

1. Offer Work-Life Balance

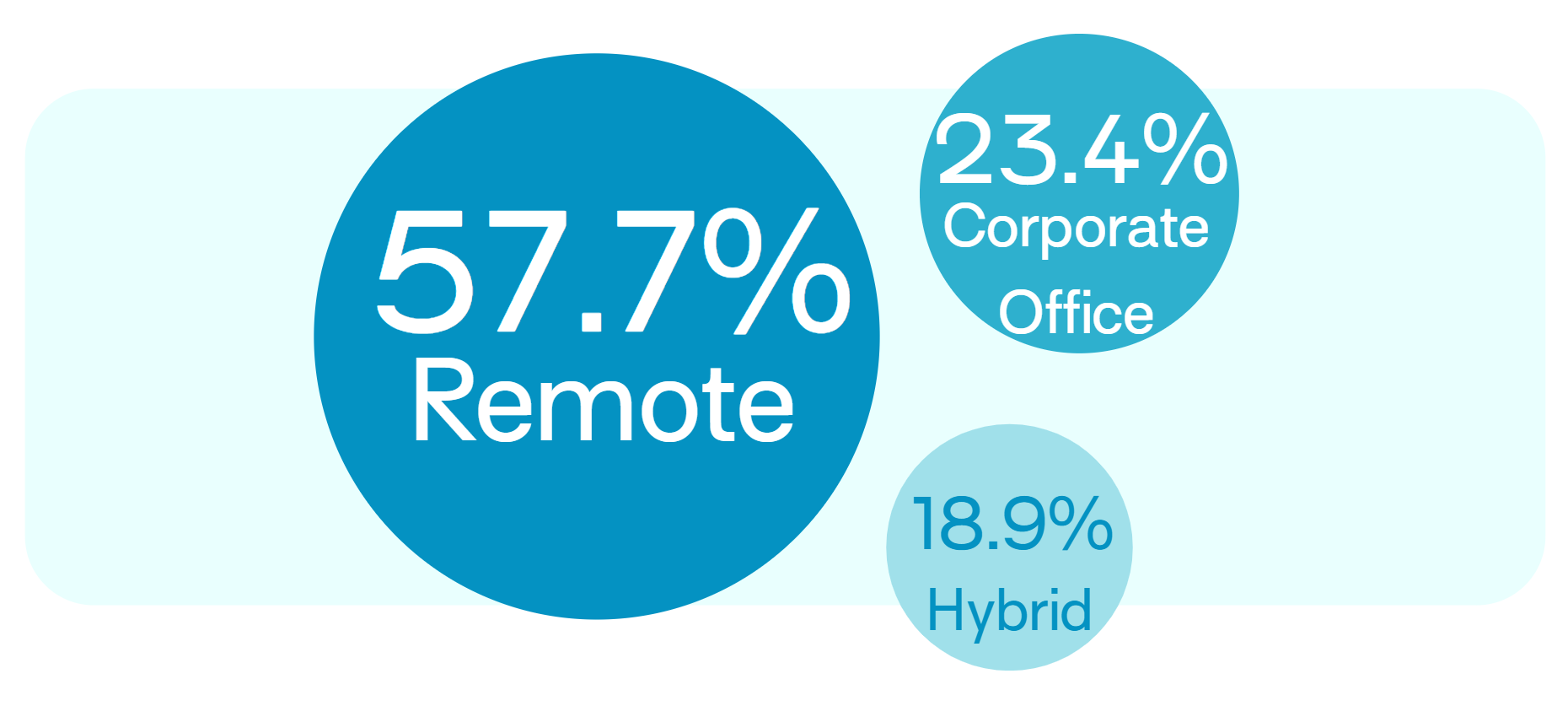

While some Gen Zers and millennials crave in-office collaboration time, most prefer to work remotely, and some want a little bit of both. Of the Gen Zers and millennials we surveyed, nearly 60% said they prefer to work remotely; 23% want to work in a corporate office; and 19% want a hybrid work environment. The common thread we have seen is that these generations want a balance between their work and personal lives – which looks slightly different for everyone.

Source: Reaching the Rising Generations in Insurance report Interviewee Insights

Cassandra: I would say the work environment I find the most productive for me right now is partially home and partially in the office. I enjoy starting my day at my house. But working with a team and whatnot, I think a day or two a week in the office is great.

Mamadou: Building relationships with colleagues behind a desk or over the phone is hard. So, I think it's important to come into an office to share ideas, maybe one or two days a week. But I think, for the most part, we are seeing the world change into more of a hybrid work-from-home mentality.

Raghav: Generally, I'm the most productive in the office. Working in an at-home environment is hard with a little kid, a dog, a wife, and everyone in the house. So, I generally like to be in my office, but I understand why some people like to work from home. I like the flexibility. I think it depends on the person.

-

2. Provide Quick and Easy Experiences

These tech-savvy generations expect seamless digital experiences as employees and customers. They think that technology has improved the industry and see even more potential on the horizon. Almost 70% of our survey respondents said the industry's biggest growth opportunity is offering quick and easy digital experiences. This includes daily transactions for customers and employees – whether filling out an application for work, communicating with peers, or submitting a quote.

Interviewee Insights

Cassandra: One way I think the insurance industry could do better in servicing its customers is having the agencies and the carriers on a similar platform with one another, with our systems being able to talk to each other better. So, nothing misses, nothing slips through the cracks. You can see the stages of an application or something like that.

Mamadou: I think technology has played a huge role, and we're seeing more companies come in from a technology perspective. I think ease of use and ease of work is what retail agents are going towards.

Raghav: I think insurance has a lot of pain points. I think technology can fix quite a few of them. I think analytics and reporting insights are areas where insurance historically has lacked. There are companies trying to achieve insights and provide agencies and carriers with better knowledge of their data. I don't think we're close to where we need to be, and technology over the next five years will probably enhance that quite a bit.

-

3. Be Clear with Communication

Transparency was a theme in our interviews and survey results – 68% of our respondents think the insurance industry can be more transparent. These generations want to feel included in the conversation.

Interviewee Insights

Cassandra: Truthfully, I think the insurance industry does a wonderful job of being transparent with its customers. At least at Eastern, we will market you to everything we have. We will not just market you to a carrier that will give us a higher commission.

Mamadou: I think the insurance industry can be more transparent when trying to service customers. Obviously, we are in a hard market. There are a lot of changes going on.

Raghav: I think that the insurance industry does a decent job communicating with their agencies and partners. The carriers do a good job with agencies. Agencies do a decent job with their clients. I think we fall short is carriers’ transparency with claims and payments and everything else when it comes to their insureds.

Reach These Tech-Savvy Generations

Check out our Reaching the Rising Generations in Insurance research for more interviews that include audio and stats from our survey. Watch your inbox and the Ivans blog for more in this series on how to reach the rising generations in insurance. Get to know more about these generations in our first blog post.

-

Taira Mandy

Director of Customer Success

Taira Mandy is the former Director of Customer Success at Ivans. The Customer Success team helps carriers better meet their goals while using Ivans products and services. Prior to this role, Taira managed customer success for the Ask Kodiak platform. In addition, she has direct experience working in product management for a P&C carrier.